UK motor insurers suffered their worst underwriting performance in a decade in 2022 as inflation drove up the cost of claims. Profits shrunk as the price of repairs, labour, and used cars all surged. Motor insurers must use this turbulent period as a catalyst to iron out operational inefficiencies and deliver more personalised insurance, even as cost pressures ebb.

The perfect storm of inflation in claims costs, a spike in accidents amid increased post-pandemic driving, and downward pressure on premiums with new pricing regulation hit insurers at once in 2022:

- The pandemic period represented two years of profitability with lower volumes of claims due to an enforced lull in driving.

- However, unfavourable market conditions in the form of higher claims costs reversed this profit trend last year.

- UK motor insurers’ net combined ratio (NCR) – claims and costs as a percentage of premiums – worsened by around 13% from 96.6% to 5% in 2022(anything above 100% signals an underwriting loss).

- Further losses – albeit to a lesser degree – are expected in 2023. EY forecasts an NCR of 108.5%.

- UK motor insurer Admiral revealed a group underwriting loss last year.

- While Canada-based insurer Intact exited the UK personal motor insurance market citing similar inflation-induced difficulties.

Motor insurance premiums jumped 35% in February year over year – and the current pricing hardening will be welcomed by motor insurers as claims costs continue to surge. UK motor insurers paid out £2.4 billion in the first quarter of 2023 – the highest figure in over a decade. Despite this, thanks to price hikes, motor insurers should return to profitability by 2024, per EY. Yet higher monthly premiums to the tune of £79 per policy won’t bring much joy to insurance customers increasingly hard-pressed by the cost of living crisis.

Insurers should take these difficult few years as a stark reminder of the progress that they still must make to digitise their operations and impetus to address long-standing issues. Digitising the claims process will drive significant cost savings, while data-driven insurance coverage will create more tailored insurance that better manages risk.

Transforming claims with AI and analytics to combat inflation

The highly manual claims process could finally be truly disrupted as insurers appear bullish on the transformative impact of AI. Global insurers identify claims as the number one use case for generative AI as it can create significant cost savings by increasing the productivity of claims handlers and drive efficiencies across the entire process.

AI will extract relevant policy information from a mountain of documents and compare claims against coverage inclusions and exclusions to make a recommendation on the payout to the handler. Models will also be fed historical data to build more accurate hypotheses on coverage inclusions and exclusions.

This is the same process that claims handlers have always manually gone through. Yet the combination of generative AI, natural language processing (NLP), and optical character recognition (OCR) will save claims handlers hours of time sifting through lengthy documents while greatly enhancing the speed and accuracy of decision making. AI will make a huge initial impact on high-volume, low-complexity claims in the short- to mid-term. Simple claims will be settled on the same day instead of taking weeks. Claims handlers will be able to process far higher volumes of claims per day while making better decisions.

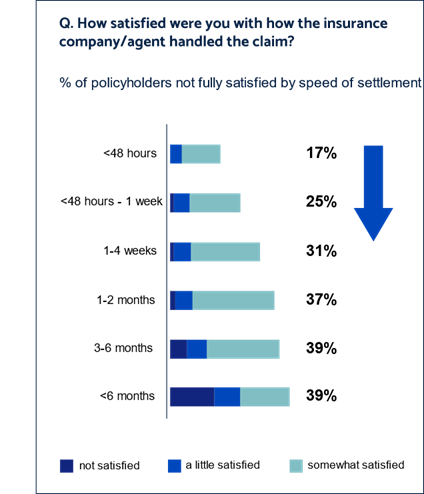

Faster claims settlement will also drive greater policyholder satisfaction in addition to operational efficiencies. Claims are the “moment of truth” in the insurance customer relationship: Ninety percent of customers that have a “bad” or “very bad” experience won’t purchase insurance from that provider again, while two thirds that have a good experience are retained. And a gap is opening up between settlement times and expectations: Customers increasingly expect claims to be resolved in a week at most, yet the reality is more than half wait more than two weeks, per Sprout.ai. Accenture estimates that claims dissatisfaction could cost global insurers up to $170 billion in renewal premiums over the next five years.

Source: Accenture

Source: Accenture

Innovative insurers have already made great strides with faster claims processing: US insurtech Lemonade handles around half of its claims using AI. And Zurich is said to be experimenting with generative AI across its claims and underwriting functions. Zurich UK says it can already settle 45% of its claims in real time using AI, and will likely be searching for even greater efficiencies through generative AI.

Looking ahead, AI will enable insurers to better predict the final outcome of claims and drive more accurate loss reserving, while more quickly and accurately detecting fraud by identifying patterns and indicators of fraudulent activity (fraudulent claims cost UK motor insurers £577 million in 2021).

Usage-based insurance will drive customer engagement while managing risk

Motor insurers will go all in on usage-based insurance (UBI) to capitalise on the opportunity to boost customer satisfaction while also lowering claims risk. UBI insurance tracks driving via apps or in-car telematics devices and allows insurers to reward safer driving with lower premiums. Policies that can be tailored on a monthly basis will give insurance customers the flexibility and personalisation that they crave. And in return, UBI insurance gives insurers a golden opportunity to ramp up the frequency of interactions with their customers with nudges on how to drive more safely and get rewarded. This will allow insurers to lower the frequency accidents while also more accurately pricing policies.

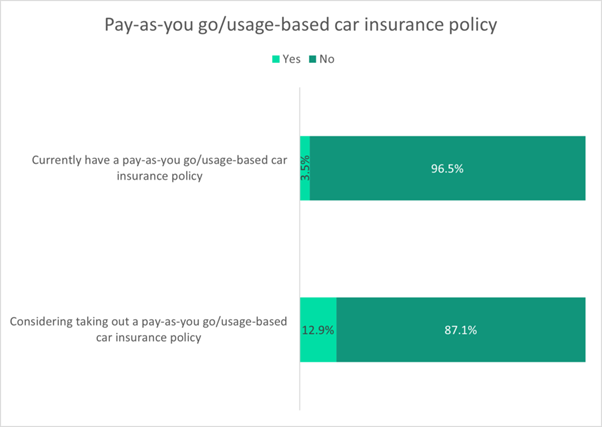

The pandemic period shone a light on the benefits of flexible insurance coverage as premiums remained unchanged despite cars being stuck on drives during lockdowns. Yet UBI insurance hasn’t truly taken off: Only 3.5% of UK insurance customers have a motor UBI product. Insurers will likely focus on better marketing and promoting the benefits of UBI insurance.

Source: GlobalData’s 2022 UK Insurance Consumer Survey

Source: GlobalData’s 2022 UK Insurance Consumer Survey

Want to know more?

BJSS works with leading players in the insurance ecosystem across general, life and pension, reinsurance, and insurtech. We help insurers to implement AI and realise the value from their investments. We also have industry-leading approaches to helping organisations become data-driven:

- Lean Data is our proprietary approach to delivering successful data projects that creates a single version of truth and aligns business and IT stakeholders.

- Customer Insights accelerates customer experience transformations by unlocking accurate, unified, and timely customer insights.

Get in touch if you’d like to know more about AI, data analytics, or our other areas of expertise in financial services. You can also click here to learn more about our insurance work or here for our wider financial services work.

Published

April 29, 2024Reading time

4 minutesRelated posts