Energy is at the top of everyone’s minds right now and it’s no wonder why: a surge in global gas prices, a significant rise in the energy cap, and even Martin Lewis warning that household bills could rise by as much as 54%. It’s not an encouraging situation.

The increase in global gas prices has highlighted the UK energy market’s reliance on fossil fuels. Many consumers, hoping to evade the rising price of gas and other traditional energy sources, have switched to renewable energy companies. However, for a variety of complex reasons, this doesn’t protect customers from global market forces. About a third of the electricity on the National Grid comes from renewable sources, more than a third from natural gases, and the rest from other sources like nuclear power. Energy is pooled in the grid, so whenever demand is greater than what’s produced by renewables, non-renewables must make up the difference. Therefore, gas plants are required to produce energy most of the time and they will not run unless they can cover their operating costs – which are high due to the cost of natural gas. As a result, non-renewable generators effectively set the overall price of energy for customers.There's clearly room for improvement in how energy customers interact with their providers. To better understand the challenges, we carried out an internal survey, speaking to 106 of our BJSS colleagues about how often they speak to their energy company, why, and the kinds of services they would want in the future.

We found that there is a long way to go before customers feel properly empowered and incentivised to change their energy consumption behaviour in ways that will reduce bills and positively contribute to a greener society. Energy providers can facilitate this by offering customers detailed insights into their consumption habits, personalised guidance on how to change them, and compelling incentives to do so (with the exception of some disruptors, the energy industry doesn't offer anywhere near the level of incentivisation as retail or telecoms).

In this blog, we'll share some of the findings from our survey, highlight interesting quotes from our respondents, and discuss what the implications could be for energy providers.

Finding 1: Customers Don’t Interact With Their Provider Often

The vast majority of respondents – 93% – interact with their energy provider once a month or less. Only 2% interact every week. And when people interact with their energy provider, over three-quarters (76%) only do so to submit a meter reading or pay their bill.

Download the full infographic here >

Download the full infographic here >

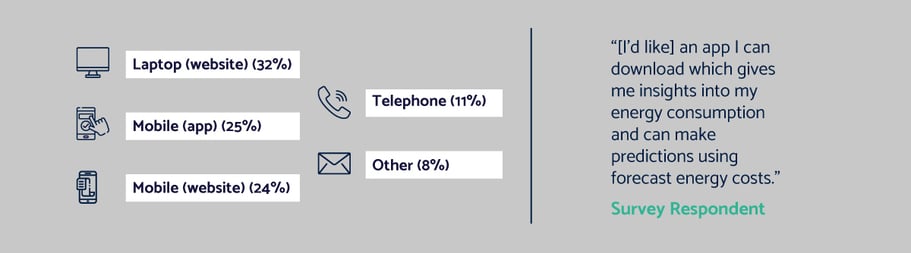

Another interesting finding from the survey is where these interactions are occurring. For example, only a quarter of customers (25%) are interacting with their energy provider through a dedicated mobile app. In fact, over half of customers (56%) are engaging through the energy company’s website, either through desktop or mobile. This represents a missed opportunity for energy companies to provide dedicated mobile apps that give customers a slick, convenient way to interact. It’s clearly something people want.

Download the full infographic here >

Download the full infographic here >

Finding 2: Customers Want More Insights From Providers

While most customer interactions with energy providers are infrequent and basic, our respondents revealed an appetite for their energy company to provide them with something more. Over four in every five (83%) people surveyed said that personalised insights into their energy usage would be of interest to them.

Download the full infographic here >

Download the full infographic here >

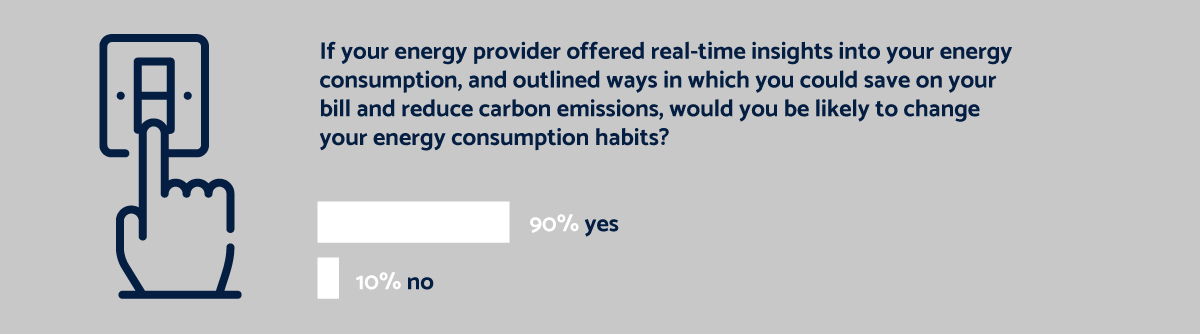

There was also a strong recognition among respondents that these insights could facilitate positive behavioural change around energy usage. Nine in ten people (90%) said they would change their energy consumption habits if they were given personalised insights into how to reduce bills or carbon emissions.

Download the full infographic here >

Download the full infographic here >

It was a point that came up in the written feedback again and again – people want insight into their energy consumption and personalised recommendations on how to improve their energy habits. There’s also a clear gap in customer knowledge around how much energy we’re consuming when we use, for example, our washing machine, our kettle, or when we leave the light on in a room.

“We have a million devices all plugged in. I'd like to know more about energy consumption and pinpoint the items which are driving the bills up.”

- Survey Respondent

Insight into this would help reduce wasteful energy behaviours – not just saving customers money but reducing overall energy consumption and limiting environmental impact.

“I would look to my energy provider to educate me on how my household habits impact the environment.”

- Survey Respondent

In fact, our respondents want greater transparency from providers on where they are sourcing energy:

“[I want to see] the proportion of the energy they sell which comes from renewables, fossil, nuclear, etc.”

- Survey Respondent

Customers want to know where providers source their energy from and, increasingly, they want it to be from renewables like wind and solar. And while we’ve seen a recent shift toward green tariffs, as discussed earlier, the wider energy market is fundamentally tied to the cost of fossil fuels, meaning the price of energy overall will increase or decrease in relation to the cost of gas. Nonetheless, there is a desire from customers for more transparency around where energy comes from than providers currently deliver.

Finding 3: Providers Should Offer Rewards To Incentivise Behaviour Change

“[I’d like] personalised insights and incentives (cash or otherwise) to encourage reduction of consumption.”

- Survey Respondent

“I like the idea of gamifying energy consumption - incentivise people to look closer at what they are using, and reward them for reducing it.”

- Survey Respondent

Energy retailers are far behind other industries in terms of motivating customers to join and stay with them. In telecoms or retail, for example, customers are often incentivised with discounts, bolt-ons or additional services, but this isn't typically seen in the energy industry. The relationship is far more transactional - you pay for energy and they provide it. To facilitate positive energy behaviours that will reduce bills and lessen environmental impact, energy providers need to find ways to make it worthwhile for customers.

Octopus Energy’s Big Dirty Turn Down event, in partnership with National Grid ESO, is the most notable attempt to provide this kind of incentive. As mentioned earlier, there are times when renewable energy generation doesn’t meet demand on the grid – for example, still or overcast days when wind and solar power generation is low. When this happens, so-called “dirty” energy sources like coal and diesel plants make up the difference.

At each Big Dirty Turn Down event, customers that consciously reduce energy usage at these times will be rewarded with free energy by Octopus. The idea is that if enough households use less energy at times when generation from renewable sources is low, there will be less need for more polluting energy sources to compensate. And by providing the right incentives to customers to adopt different consumption habits, the Big Dirty Turn Down could provide a template for achieving more widespread change in the long run – and reducing our reliance on fossil fuels. As the event website states: “While your own home might only be a small drop in the ocean, every ocean is made up of many drops; so put enough of them together and they soon add up.”

Conclusion

We wouldn’t, of course, consider our survey sample size representative of the wider UK population. Nonetheless, the questionnaire generated some valuable insights into what customers want from their energy providers. Namely, greater transparency on energy sources, real-time insight into energy usage, personalised insights into how to change energy consumption habits, and incentives for making those behavioural changes.

However, to give customers what they want, energy providers must prioritise significant programmes of user-centric digitalisation, build enterprise data platforms that can harness and present massive amounts of information, and facilitate a level of interoperability with other parts of the energy ecosystem that the industry has not seen before.

In future blog posts, we’ll discuss what’s getting in the way of these innovations, both the technological barriers and the unique structural challenges presented by the UK’s energy system. Some of the same challenges are covered in our free eBook, Digital Innovation in Energy, Commodities & Utilities, which discusses ways in which the industry can structure processes differently to drive more value and efficiency in projects.

.svg)